The Central Bank of Turkey and the justice authorities have taken a landmark step in regulating the digital market. According to the new amendments, cryptocurrency assets are officially recognized as property for debt collection purposes.

What does this mean in practice?

For creditors: A new, previously unavailable debt collection tool is being opened. Now it is possible to seize not only real estate, bills and cars, but also the debtor's digital assets.

For unscrupulous debtors: The popular scheme of avoiding liability by transferring funds to cryptocurrency stops working. The law makes it impossible for them to hide their assets from justice.

This is an important signal for all investors and market participants: Turkey is building a transparent and regulated financial ecosystem where digital assets become a full part of it.

On October 10-12, behind the Old Town Hall at a festival full of colors and sunshine!

On October 10-12, behind the Old Town Hall at a festival full of colors and sunshine!

TURKEY LAUNCHES ITS OWN PRODUCTION OF MICROCHIPS

TURKEY LAUNCHES ITS OWN PRODUCTION OF MICROCHIPS

Turkey: a new level of control in the network

Turkey: a new level of control in the network

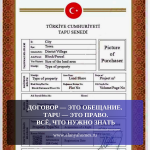

The contract is just the beginning, and ownership is TAPU.

The contract is just the beginning, and ownership is TAPU.

TURKEY STRENGTHENS CONTROL: CRYPTOCURRENCY IS EQUATED TO PROPERTY

TURKEY STRENGTHENS CONTROL: CRYPTOCURRENCY IS EQUATED TO PROPERTY